According to a recent survey conducted by 7thonline, 34% of retail leaders are concerned about declining consumer spending for this year—and this fear isn’t unfounded. May’s retail sales data was released this week, declining more than expected with the biggest drop in four months. However, apparel sales tell a different story.

Excluding automobiles, gasoline, building materials and food services, May’s “core” retail sales increased .4%, after an upwardly revised .1% fall in April, suggesting a modest pick up in consumer spending this quarter; clothing sales rose by 10bps between April and May. However, downside risks to consumer spending are rising: slower labor market, student loan repayments resuming, tariff-induced stock market volatility, etc. While tariffs have had a clearer impact on large-ticket items, markets are signaling a slowdown for the second half of the year as tariffs begin to weigh on disposable incomes, according to Michael Pearce, deputy chief economist at Oxford Economics.

7thonline’s survey of 100+ retail executives revealed that 73% of leaders are expressing concern over rising tariffs over the next year, with over 1 in 3 confessing their first response to new tariffs would be to adjust product pricing. Some retailers have been transparent about their plans to hike prices but others have not yet disclosed their strategies.

“Past experience suggests the biggest price rises will come in July, though the full impact of the tariffs likely will emerge across the whole of the remainder of the year,” said Samuel Tombs, chief US economist at Pantheon Macroeconomics.

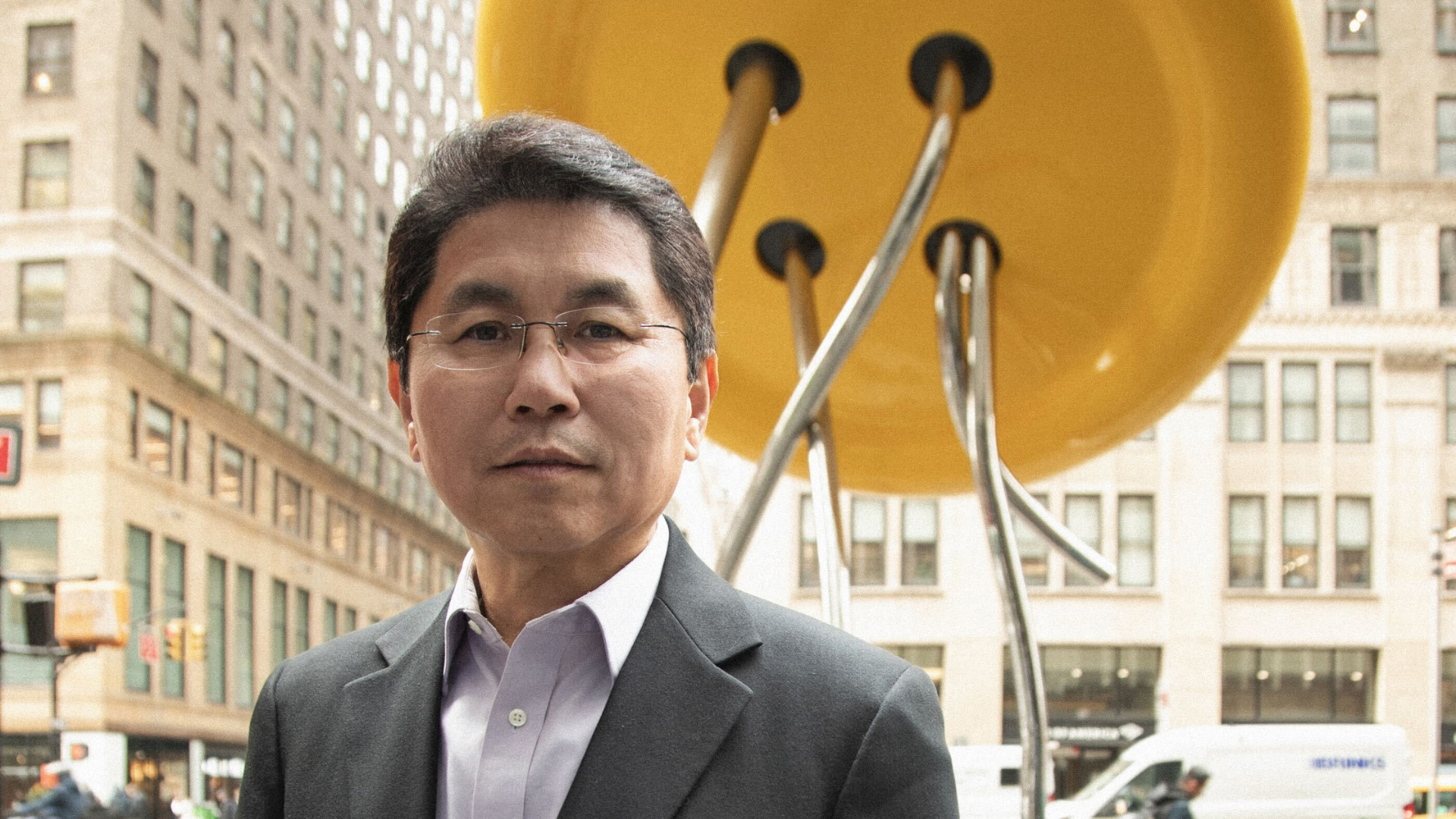

Despite distress around consumer spending, price adjustment is the go-to move due to low margins—over 75% of retailers said that they would be unable to absorb more than a 25% increase in tariff costs. 7thonline CEO, Max Ma, shared with Sourcing Journal that because margins are slim, navigating spending discretion amid increased tariffs is especially challenging but “many retailers…are pressuring their suppliers to lower prices, so they’re trying to do it on both sides.”

Here are five more strategies retailers and wholesalers can adopt to offset the cost of tariffs: https://www.7thonline.com/post/five-tariff-strategies-for-retail

While tariff news and fears may have come off their peak, the effects are still yet to be fully seen. To learn more about how your team can use AI to navigate shifting consumer demand, email us at info@7thonline.com or book a demo with our team.