Key Takeaways

- 33% of retail executives are currently using AI to analyze data/forecast demand.

- Over 1 in 5 retail executives lack confidence in their supply chain’s ability to handle disruptions.

- 73% of retail executives express concern about additional increases in tariffs over the next 12 months.

- 35% of retail executives say their first response to a new tariff increase would be to adjust product pricing.

Evolving demand, rising tariffs and rapid advancements in AI are reshaping the retail landscape. This report analyzes how retail leaders are adapting their strategies in 2025, drawing on insights from a survey of over 100 retail executives. From supply chain confidence to technology adoption, the findings offer a look into the challenges and priorities shaping today’s retail strategy.

Demand Is Shifting—and Retailers Are Feeling the Pressure

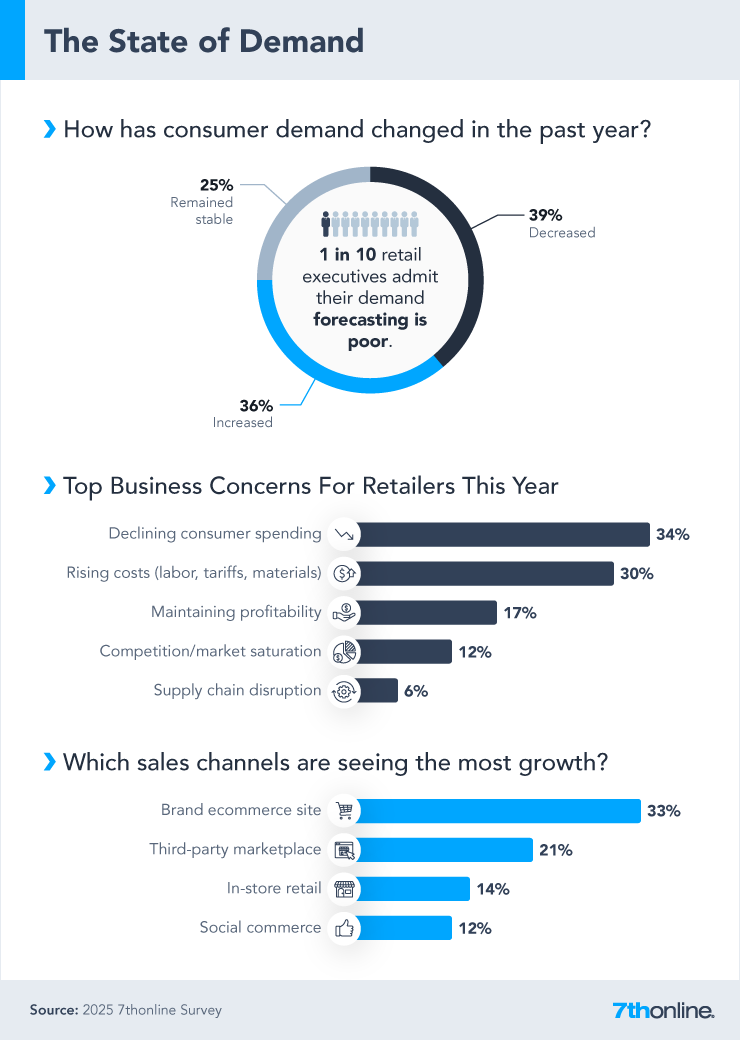

While 36% of executives say demand has increased, a larger share (39%) report a decline. With 1 in 10 admitting their forecasting is poor and concerns mounting over consumer spending and rising costs, retail leaders are navigating a highly complex demand landscape.

As consumer demand shifts, retailers are seeing the strongest growth through branded ecommerce channels, with 33% reporting increased activity on their own sites. This suggests that more consumers are seeking direct-to-brand experiences, while traditional in-store retail and social commerce are capturing a smaller share of emerging demand.

Retailers Are Reinforcing Supply Chains—But Confidence Remains Mixed

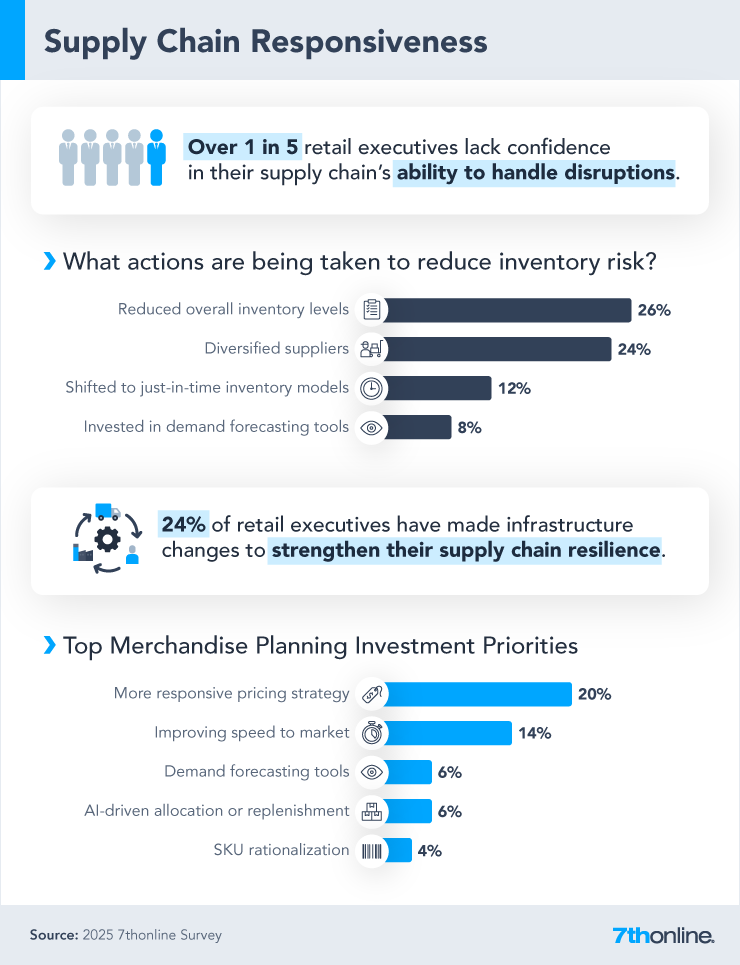

More than 1 in 5 retail executives say they’re not confident in their supply chain’s ability to manage disruptions. To reduce risk, many are cutting inventory levels, diversifying suppliers and making infrastructure investments aimed at improving flexibility and resilience.

To reduce inventory risk, retailers are taking tactical steps like cutting inventory levels and diversifying suppliers—but their long-term focus is shifting toward smarter merchandise planning. More responsive pricing strategies (20%) and speed to market (14%) top the list of investment priorities, reflecting a push to become more agile amid ongoing supply chain uncertainty.

Tariff Pressures Are Forcing Retailers to Rethink

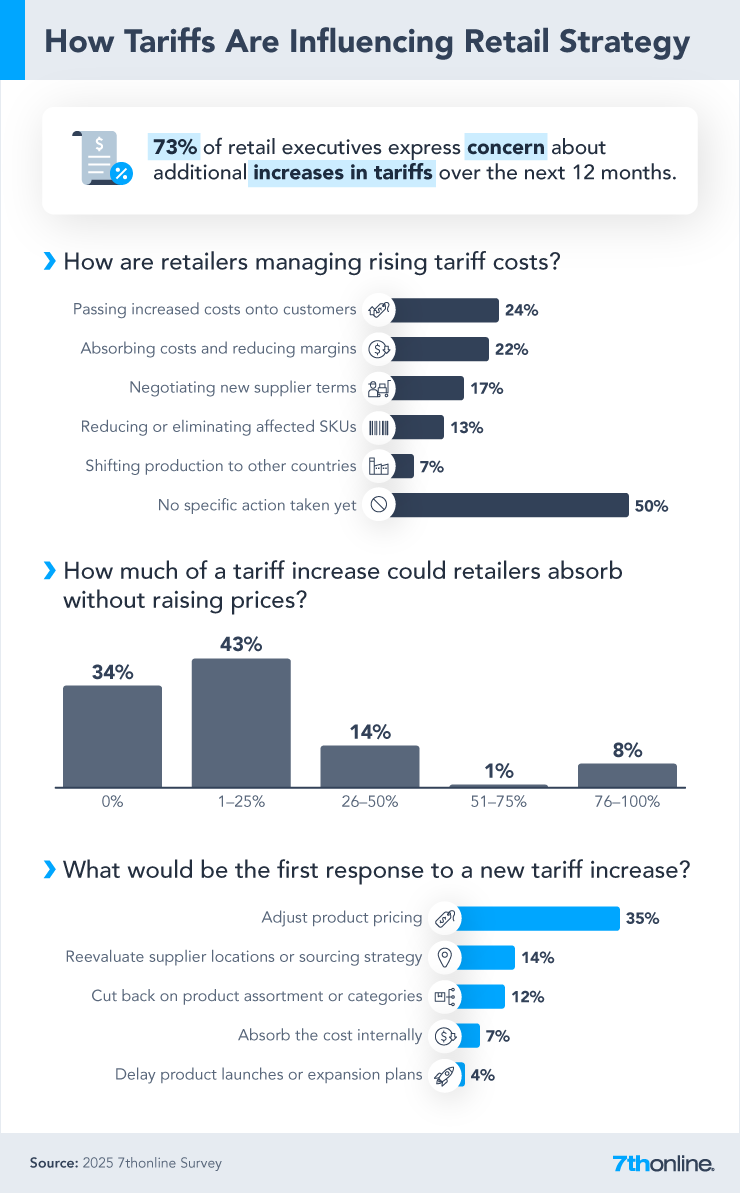

With 73% of retail executives expressing concern about rising tariffs over the next year, many are already weighing how to manage increased costs. From passing costs onto consumers to renegotiating supplier terms, retailers are navigating complex decisions in an uncertain economic environment.

Half of retail executives have yet to take specific action in response to rising tariff costs, but among those who have, the most common strategies include passing costs to customers (24%) and absorbing them internally (22%). Most retailers say they could only absorb a 25% tariff increase or less before needing to raise prices, and 35% say their first response to a new increase would be to adjust product pricing—highlighting how limited their flexibility truly is.

Retailers Are Cautiously Exploring AI—But Barriers Remain

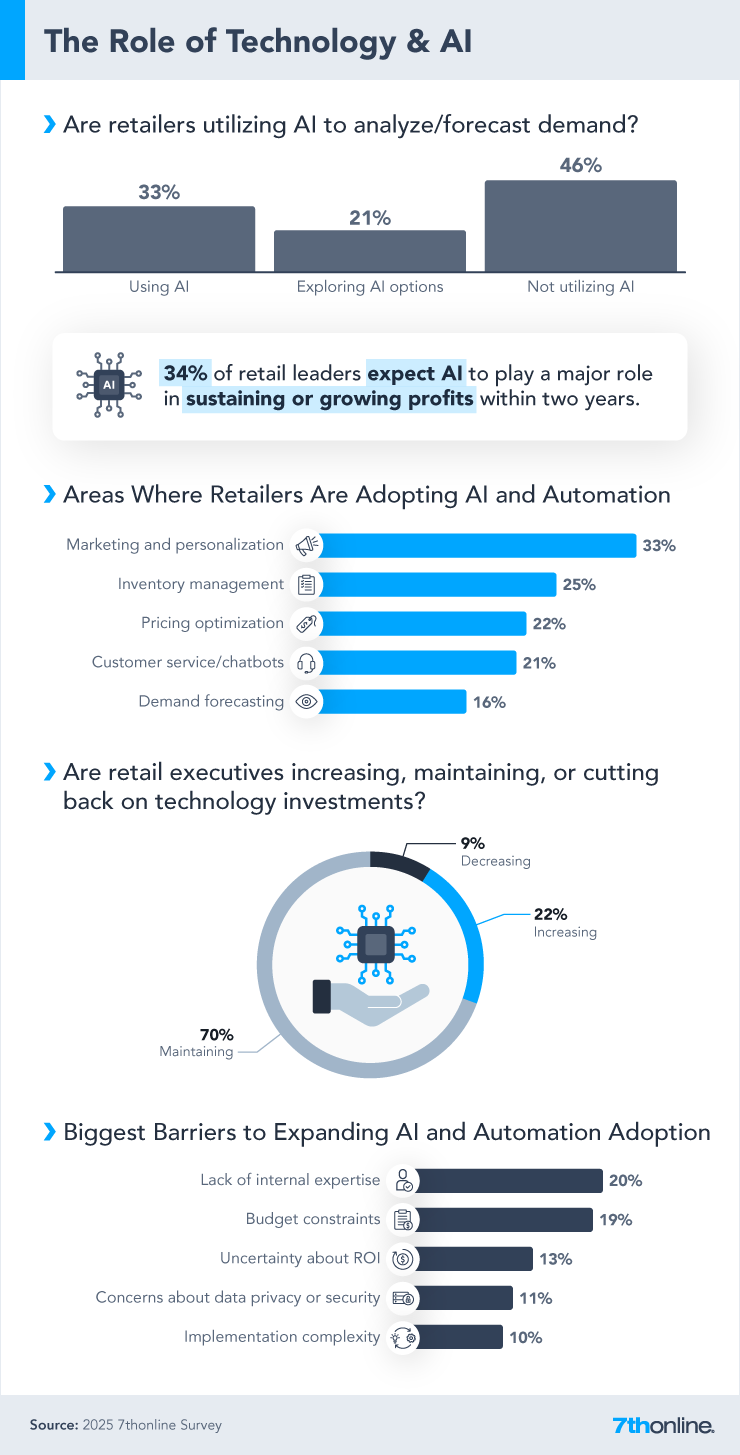

A third of retail executives are already using AI to forecast demand, and 34% expect it to play a major role in sustaining or growing profits within the next two years. While most are maintaining their current tech investments, adoption is still limited by internal expertise gaps, budget constraints and uncertainty about ROI.

Retailers are exploring a range of AI applications, with marketing, inventory management and pricing optimization leading the way. Only 16% are currently using AI for demand forecasting—despite growing recognition of its potential.

What’s Ahead for Retail Strategy

Retailers are balancing immediate pressures with long-term priorities—from managing tariff impacts to cautiously adopting innovative technology such as AI. As 2025 unfolds, building flexibility, improving forecasting and investing in strategic planning will be key to staying competitive.

Methodology

7thonline surveyed 105 retail executives about their retail strategy from June 2-11, 2025. Of the respondents that disclosed their job title, 53% were C-suite executives, 16% were owners and 8% were directors.

7thonline is a leading AI-powered retail planning and forecasting software, enabling more effective planning, demand forecasting and inventory optimization for leading retailers and wholesalers. With embedded business intelligence and rich analytics, the solution offers complete demand visibility and planning capabilities at the most granular level. To learn more about our suite of solutions, book a demo or email us at info@7thonline.com.